The Modest Billionaire

The Modest Billionaire

Among the most successful stories of the post-liberalisation era include Nirmal Jain’s feat of creating one of India’s largest financial conglomerates from scratch. An IIM-Ahmedabad alumnus and chartered accountant, in a stimulating interaction, Jain lets MARWAR in on his journey from the campus to heading the R25,000 crore IIFL Holdings Ltd as its founder chairman, in a little over two-and- a-half decades.

Text: Joseph Rozario

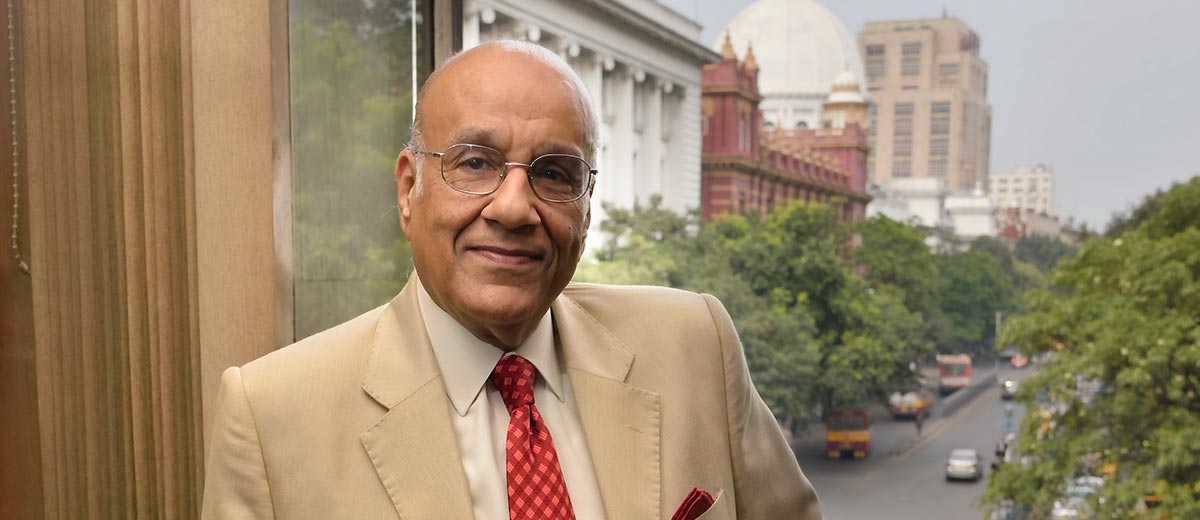

Except for his expansive office, everything about Nirmal Jain belies the billionaire in him. Simple, informal and modest, he brushes off recent newspaper reports about his net worth touching the $1 billion mark, after the private wealth unit of IIFL Holdings, the financial services company of which he is the founder and chairman, registered unusual growth, taking the unit’s total ‘assets under management’ to $20 billion.

Except for his expansive office, everything about Nirmal Jain belies the billionaire in him. Simple, informal and modest, he brushes off recent newspaper reports about his net worth touching the $1 billion mark, after the private wealth unit of IIFL Holdings, the financial services company of which he is the founder and chairman, registered unusual growth, taking the unit’s total ‘assets under management’ to $20 billion.

For all his simplicity and humility, have no illusions about the man, however, when it comes to enterprise. Motivated and driven, his boundless energy shows in his restlessness, which combined with his sound academic background and attributes of honesty and hard work have helped him build what today is India’s leading financial services conglomerate—from scratch!

Humble beginnings

The son of a trader who moved to Bombay (now Mumbai) at the age of eight from the Jains’ ancestral home in Haldighati near Udaipur, Nirmal Jain’s father’s bequests to him were more in the nature of values than a business legacy. “Honesty, integrity and hard work are some of my greatest takings from my father, and they have been a great contributor in my approach towards life and business. One of the greatest lessons I have learnt from him is that one needs to be conservative, even as one should look for the best opportunities to grow,” says Jain.

The son of a trader who moved to Bombay (now Mumbai) at the age of eight from the Jains’ ancestral home in Haldighati near Udaipur, Nirmal Jain’s father’s bequests to him were more in the nature of values than a business legacy. “Honesty, integrity and hard work are some of my greatest takings from my father, and they have been a great contributor in my approach towards life and business. One of the greatest lessons I have learnt from him is that one needs to be conservative, even as one should look for the best opportunities to grow,” says Jain.

Values apart, Nirmal Jain is also endowed with superior intellect, which he has put to good use by giving himself a sound education. Consistently a good performer academically, after his BCom from the University of Mumbai, he appeared for his chartered accountancy exam, passing it with a brilliant all-India second ranking, while simultaneously acquiring a cost accounting qualification as well (ICWA). He next proceeded to Indian Institute of Management, Ahmedabad for his MBA, and that done, at the age of 23 stepped into the corporate world, joining Hindustan Unilever in 1989, where he handled the group’s commodity export portfolio for the next five years.

While most others would consider academic qualifications as a vital stepping stone in the journey to success, Nirmal Jain is of the opinion that academic brilliance is not the be all and end all of a successful career. “Academic success helps, but I don’t think there is any direct correlation between academics and a successful career as such. Once you leave academics, you reach the school of life, where you learn by hard knocks,” he says.

A financial services colossus

A financial services colossus

Nirmal Jain is 51 now and he has already achieved more than what you would expect from a man who started his career as an employee of Hindustan Unilever. IIFL, or India Infoline Group, the conglomerate he heads as chairman, comprises holding company, IIFL Holdings Ltd which has three main business lines that come under IIFL Finance Ltd, IIFL Wealth Management Ltd and IIFL Securities, or India Infoline Ltd. IIFL Finance Ltd offers home loans, loans against properties, SME and micro finance loans and others through a pan-India network of 1,387 branches in 25 states. Under IIFL Wealth Management Ltd, a market leader, the group manages and advises assets worth R1,31,762 crore from 10,000 high net worth families across the globe. Among its products include family office, AIFs, advisory and distribution services, etc. IIFL Securities, which also is a market leader in the broking space, has close to 1,200 service locations comprising a branch and sub-broker network, through which unparalleled research coverage on over 500 companies is provided.

These apart, the group has its mobile trading app, IIFL Markets, on Android, which caters to a steadily increasing number of clients trading through the mobile platform. The app continues to be the highest rated among peers with over 15 lakh downloads.

These apart, the group has its mobile trading app, IIFL Markets, on Android, which caters to a steadily increasing number of clients trading through the mobile platform. The app continues to be the highest rated among peers with over 15 lakh downloads.

Overall, IIFL Holdings serves 4 million satisfied customers across various business segments, has a workforce of over 13,000 and was listed as the top securities trading firm in India in Fortune 500 India list in 2014. For FY18, it has reported an income of R3,863.7 crore and profit of R1,162.1 crore. Its net profit has risen by 35 per cent on a compounded annual basis since FY14.

A wild, gut-wrenching ride

However, behind IIFL’s gigantic proportions and fame and fortune lie years of hard work, trials, errors and misses and, of course, the “hard knocks” that Jain talks about. “Expect your opportunity and journey to be a wild, gut-wrenching ride that could last decades. Only one person in 10 million gets rich quick. The winners are endlessly flexible, tenacious folks, who never quit,” he says.

However, behind IIFL’s gigantic proportions and fame and fortune lie years of hard work, trials, errors and misses and, of course, the “hard knocks” that Jain talks about. “Expect your opportunity and journey to be a wild, gut-wrenching ride that could last decades. Only one person in 10 million gets rich quick. The winners are endlessly flexible, tenacious folks, who never quit,” he says.

Coming from a small business family, Jain started his entrepreneurial career with almost no capital. The only weapons in his arsenal in those days were hard work, integrity, flexibility and above all, his ability to grasp new opportunities. The Hindustan Unilever stint did serve as a good start, standing him in good stead, as, contrary to popular opinion that MNCs and entrepreneurship are disconnected, Jain says he has learnt a lot from the multinational, which at a later stage helped him put systems and processes in place and also scale up his business.

In the mid-nineties Jain quit Hindustan Unilever to join the Motilal Oswal Group, where he helped launch the institutional equities division of the group. Working with group co-founder Raamdeo Agrawal, he set up a new research unit called ‘Inquire’ (‘Inquire’ being the acronym for ‘Indian Equity Research’), which raised the bar of equity research in India. It was while working for the group that the entrepreneurial bug bit him. Looking back, Jain says, “That was a time when India was dreaming of growth post economic reforms by Dr Manmohan Singh and Prime Minister PV

In the mid-nineties Jain quit Hindustan Unilever to join the Motilal Oswal Group, where he helped launch the institutional equities division of the group. Working with group co-founder Raamdeo Agrawal, he set up a new research unit called ‘Inquire’ (‘Inquire’ being the acronym for ‘Indian Equity Research’), which raised the bar of equity research in India. It was while working for the group that the entrepreneurial bug bit him. Looking back, Jain says, “That was a time when India was dreaming of growth post economic reforms by Dr Manmohan Singh and Prime Minister PV

Narasimha Rao. Maybe I was at the right place at the right time, because the capital markets were still very small and India was about to take off.”

So, thankful for having learnt his first lessons of the capital market from veterans like Motilal Oswal and Raamdeo Agrawal and considering himself fortunate to be an early entrant in the market, after one-and-half years he left the Motilal Oswal Group to start on his own.

Feeling that there was dearth of quality research in India, Jain started Probity Research in 1995. With lady luck smiling upon him, he found good clients soon, raking up revenue of almost a crore. Spurred on by the good start, a few years down, Probity Research released a report on the IT sector which became a rage, given that it coincided with the peak of the dotcom boom. As was natural, it heightened Jain’s expectations of seeing a quantum leap in the company’s subscriber base, considering the fact that the reports were being reads by thousands. But the subscriptions grew much slower than the usage or popularity of the reports, because they were being scanned, e-mailed, printed and shared with thousands of people. There was no law that could prevent that from happening. In utter frustration, he put the entire lot of research reports on the Internet, in the hope that with increased readership, the company would be able to garner some advertisement revenue instead. This, however, did not go down well with some of his team mates, who called it “madness”. But it was to serendipitously redefine the company’s business by taking Probity Research in another direction altogether, marking the beginning of a long, successful journey.

Feeling that there was dearth of quality research in India, Jain started Probity Research in 1995. With lady luck smiling upon him, he found good clients soon, raking up revenue of almost a crore. Spurred on by the good start, a few years down, Probity Research released a report on the IT sector which became a rage, given that it coincided with the peak of the dotcom boom. As was natural, it heightened Jain’s expectations of seeing a quantum leap in the company’s subscriber base, considering the fact that the reports were being reads by thousands. But the subscriptions grew much slower than the usage or popularity of the reports, because they were being scanned, e-mailed, printed and shared with thousands of people. There was no law that could prevent that from happening. In utter frustration, he put the entire lot of research reports on the Internet, in the hope that with increased readership, the company would be able to garner some advertisement revenue instead. This, however, did not go down well with some of his team mates, who called it “madness”. But it was to serendipitously redefine the company’s business by taking Probity Research in another direction altogether, marking the beginning of a long, successful journey.

Having learnt the bitter lesson that people were not willing to pay for information but would pay for transactions, Nirmal Jain and team turned to online broking in 2001—which, incidentally, was becoming the preferred mode of transactions in USA. “We sensed the trends and decided to have a technology-driven platform, as it was clear that for the next 20 years, technology would influence everything,” says Jain. So by 2002, the company was a fully-fledged online retail broker. “Our online broking platform was called ‘5paisa’, five paisa being the brokerage fee for a transaction. This formed the foundation of the one-stop financial services shop that we know today as IIFL,” he continues.

Meanwhile, as the company metamorphosed from an independent research house to a broking firm to a financial services conglomerate, the name changed too from Probity Research to India Infoline to IIFL Holdings Ltd, as it is now called.

Honour and glory

As could be expected, along the journey, IIFL has been honoured with prestigious listings and has picked up its fair share of awards too. The more prominent among these include a Forbes ‘India’s Super 50 Companies’ listing (a benchmark to identify Indian companies that exhibit high growth in profitability, sales and shareholder returns); a ‘Outlook Business Outperformers’ listing (a prestigious list of eight companies which have beaten the Sensex over a five-year period); ‘India’s Greatest CSR Brand’ felicitation by Asia One magazine; a ‘#1 Investment Banker in Equity Issuances for FY18’ ranking by PRIME Database; a ‘Great Places to Work’ certification; ‘The Best Private Banking Services Overall, India’ award at Euromoney Private Banking and Wealth Management Survey, 2017; and ‘India’s Most Trusted Financial Service Brand (Non-Bank)’ recognition by Brand Trust Report India Study. These apart, IIFL has also received the ‘Best Customer Centric Company – Financial Sector’ recognition at World Quality Congress & Awards, 2017, the ‘Best IPO Bidding Member – Retail’ award at the NSE Market Achievers Awards, and others. On a personal level, Nirmal Jain has received the ‘CA Entrepreneur Leader Award’ in the Financial Services category for FY18, besides.

As could be expected, along the journey, IIFL has been honoured with prestigious listings and has picked up its fair share of awards too. The more prominent among these include a Forbes ‘India’s Super 50 Companies’ listing (a benchmark to identify Indian companies that exhibit high growth in profitability, sales and shareholder returns); a ‘Outlook Business Outperformers’ listing (a prestigious list of eight companies which have beaten the Sensex over a five-year period); ‘India’s Greatest CSR Brand’ felicitation by Asia One magazine; a ‘#1 Investment Banker in Equity Issuances for FY18’ ranking by PRIME Database; a ‘Great Places to Work’ certification; ‘The Best Private Banking Services Overall, India’ award at Euromoney Private Banking and Wealth Management Survey, 2017; and ‘India’s Most Trusted Financial Service Brand (Non-Bank)’ recognition by Brand Trust Report India Study. These apart, IIFL has also received the ‘Best Customer Centric Company – Financial Sector’ recognition at World Quality Congress & Awards, 2017, the ‘Best IPO Bidding Member – Retail’ award at the NSE Market Achievers Awards, and others. On a personal level, Nirmal Jain has received the ‘CA Entrepreneur Leader Award’ in the Financial Services category for FY18, besides.

Riding into the future

Given this blitz of successes, does it hint at a possible plateauing of the business, or a subdued performance in the foreseeable future? Jain negates this sentiment by painting an optimistic picture for IIFL, substantiating his growth expectations for the group with some quick maths: “India’s Real GDP is 7.5 per cent, while the nominal GDP is 12-13 per cent. Financial services is a leveraged play on the economy, meaning, if the economy does well, the financial services sector will do even better. So the estimated growth rate should be 17-18 per cent. If the markets remain buoyant, we could expect to grow at 25-30 per cent, and that would double our businesses in less than three years. In a bad market, however, this growth rate can be around 15-20 per cent.”

Given this blitz of successes, does it hint at a possible plateauing of the business, or a subdued performance in the foreseeable future? Jain negates this sentiment by painting an optimistic picture for IIFL, substantiating his growth expectations for the group with some quick maths: “India’s Real GDP is 7.5 per cent, while the nominal GDP is 12-13 per cent. Financial services is a leveraged play on the economy, meaning, if the economy does well, the financial services sector will do even better. So the estimated growth rate should be 17-18 per cent. If the markets remain buoyant, we could expect to grow at 25-30 per cent, and that would double our businesses in less than three years. In a bad market, however, this growth rate can be around 15-20 per cent.”

Though Jain’s optimism centres around three major businesses of IIFL—NBFC, wealth management and capital markets—his overall growth outlook for the industry as a whole is positive too. India’s financial industry, he feels, is still at an early stage of growth, considering the enormous size of the Indian economy and the relatively low levels of penetration of financial products and services.

As the good times continue to roll for IIFL Holdings, the company has announced demerger of its finance, capital and wealth businesses to create three different listed entities. Asked about the split, Jain reveals the rationale behind it: “We believe that all our core businesses have acquired a critical mass and need flexibility and independence to grow faster in today’s rapidly changing technology and innovation driven environment. Each company, listed separately can attract and motivate its key people with stock options such that their rewards are strongly correlated with their performance.”

Also, he feels that as separate entities, the companies would be subject to public, media, analysts’ and regulatory scrutiny, and further, a clean corporate structure with no cross holdings would ensure transparency, highest standards of governance and compliance.

Success mantras

Considering that Jain has built a colossal business group from nothing in a mere span of 23 years, one can’t help wondering about his mantras for success. Commenting about it, he says, “To be successful, one must always be flexible and pay close attention to market trends that can quickly create or destroy relevance. One must always be willing to quickly change course to capture new opportunities from trends.” His second mantra for success is his famous ‘3Hs’ which he largely attributes to his father: Honest, Hard Work and Humility. “To reach the heights of success, you must be willing to do the lowest job,” he explains. “The game is long, and your most valuable resource is your integrity. A business, however small, if run with integrity is a great business, compared to a large business run without integrity.”

A committed philanthropist

In the midst of all the success, honour and glory, the plight of the less fortunate has not remained lost on Jain. In the true spirit of Marwari philanthropy, he contributes generously to society through his charitable unit, IIFL Foundation, especially in the fields of education and healthcare. Apart from supporting the Ashoka University (in Haryana), he has undertaken the ambitious project of ensuring complete literacy of girls in Rajasthan by setting up schools in a thousand villages over the next 10 years through IIFL Foundation, in partnership with the Government of Rajasthan. That apart, his wife Madhu participates in social welfare initiatives at both the family level as well as a part of IIFL Foundation.

Away from the world of finance and enterprise, Nirmal Jain loves to go on leisurely holidays abroad with his family, whenever long vacations are available. Otherwise, he goes for long walks, or goes swimming in the club, or dabbles in golf. At home, he loves to spend time with his children, watching movies. He lives in Juhu, Mumbai with his wife Madhu and three children Harshita, Kalpita and Bhavya. Harshita has been working in the wealth division of IIFL for the last one-and-a-half years and plans to go to Stanford University soon for her MBA, while Kalpita and Bhavya are still in school. Asked about Harshita taking on after him at IIFL, he quickly reminds us that IIFL is a professionally managed company where all decisions are taken by an independent board. And on that note, we wrap up our stimulating interaction with the modest billionaire that is Nirmal Jain.