Tax-Saving Options Made Easy

If you are a young entrepreneur working on your financial portfolio, you need some expert tips in finance. We have Finfluencer ANUSHKA RATHOD sharing important information on simple tax-saving strategies.

I remember when I first paid my income tax, I felt almost cheated. I thought I had worked so hard to earn my money and had to give away a part of it to the government! So from the subsequent year, I meticulously planned my financial portfolio to pay as little tax as possible. After all, money saved is money earned. To help you save taxes, I have made a quick cheat sheet for all the tax benefits you can take! I know it can be a little overwhelming to read all the jargon and who wants to spend time on tax planning when one barely gets any leisure time? If you too think like that, then you can simply opt for the new tax regime and get rid of all the planning. The new tax regime has lower tax rates than the old tax regime reducing your payable tax! However, here, you can’t take advantage of any deductions or exemptions. Should everyone go for the new tax regime? Well, no! If you plan well and already have a financial portfolio to avail tax deductions then the old tax regime can help you save on tax! Let’s discuss a few of them.

Insurance

It is important to have insurance and plan ahead for extremities. If you meet with an accident or fall ill, your medical bill can take away all your savings and might even put you in debt, thereby setting you decades behind in your financial journey! Hence, buy your insurance as soon as possible. There is a silver lining to buying insurance! You can get a deduction of R25,000 on your health insurance premium for yourself, your spouse, and your dependent children.

Pro tip: If you are paying premium for your parents, you may deduct an additional amount of R25,000-30,000 here! Even your life insurance premiums are deductible under section 80C till R1,50,000.

Investments

You can make certain investments to save on tax under section 80C. If you want a fixed return then consider Public Provident Fund (PPF), Tax Saver FD, or NSC.

Pro tip: if you are salaried, ask your finance team to invest in Voluntary Provident Fund for you. This gives a higher return than PPF and the same tax benefit! If you want to take on more risk and increase the probability of a higher return, invest in ELSS Mutual Funds.

Rent

Rent is a huge part of our monthly expense and all those who are salaried most likely get House Rent Allowance which is tax exempt! But what about those self-employed individuals and those who don’t get such an allowance? Well, you can claim a deduction of up to R60,000 in one financial year on the rent you pay under section 80GG.

Loans

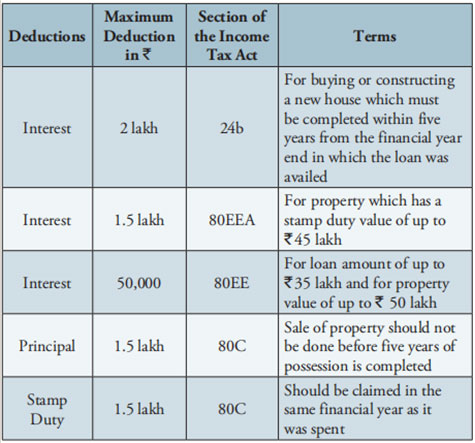

Your home loan gives you a lot of tax benefits. Here’s how:

And even education loan interest can be deducted from taxable income under section 80G.

Self Employed

If you are self-employed, there is a way you can get rid of maintaining your books of accounts while saving on tax! Under presumptive taxation, if you are a business owner with turnover below R2 crore, you can declare 6 per cent (for digital payments only) of your revenue as your taxable income and pay tax only on that! However, if you are a self-employed professional (like a lawyer, interior designer, or engineer) then you can declare 50 per cent of your revenue as your taxable income if your total revenue is below R50 lakh. Post this, you can avail all the other investment/insurance deductions as discussed in the article.

NOTE: This was a brief of a few ways in which you can save on tax. Please note that there are more details to it and certain eligibility factors to certain sections. So, read up more on these and discuss them with your finance expert.