Moving Markets

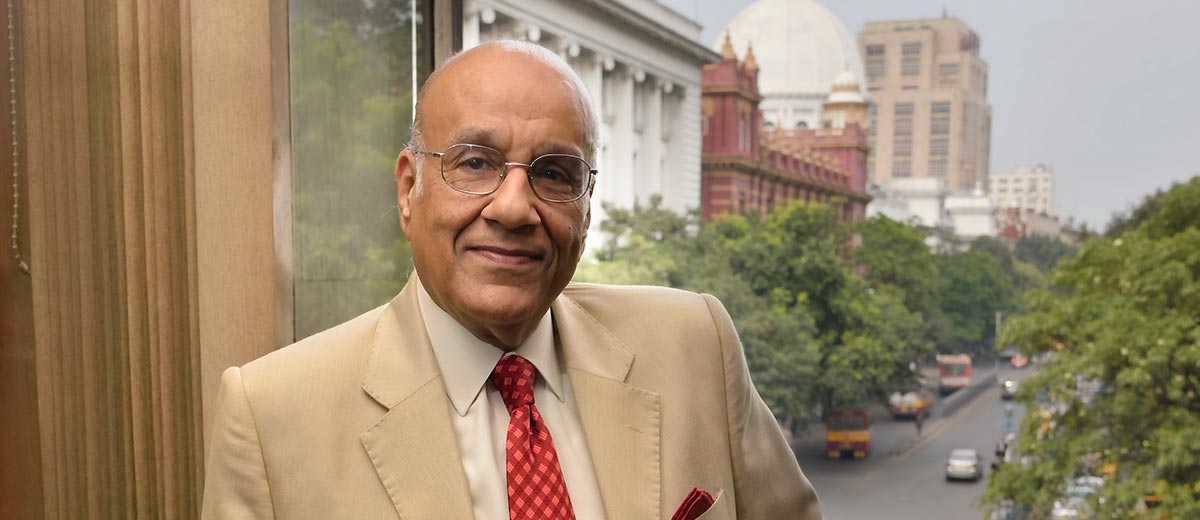

Rakesh Jhunjhunwala, often compared to Warren Buffett, is one of India’s biggest and most successful traders and investors, with a net worth of $1.95 billion.A proud Marwari and a family man, Jhunjhunwala has pledged to give Rs. 5,000 crore or 25 per cent of his portfolio value, whichever is less, to charity when he turns 60 in 2020. MARWAR meets the man to learn more about his life and work.

Rakesh Jhunjhunwala, often compared to Warren Buffett, is one of India’s biggest and most successful traders and investors, with a net worth of $1.95 billion.A proud Marwari and a family man, Jhunjhunwala has pledged to give Rs. 5,000 crore or 25 per cent of his portfolio value, whichever is less, to charity when he turns 60 in 2020. MARWAR meets the man to learn more about his life and work.

Time is money, and no one knows it better than Rakesh Jhunjhunwala. “I would like to show you a video that my friends and colleagues made for my 50th birthday,” he had told us over the phone. As we enter his office at the predetermined time, we find him peering at a computer screen, his index finger ready to hit the start button of the video recording. Not a minute wasted, he plays the video for us, even as four large trading terminals, with their numerous digits that change faster than we can follow, flash in front of us.

Rakesh Jhunjhunwala, the $1.95 billion worth trader and investor, often referred to as the Warren Buffett of India, has his office on the 15th floor of Nariman Bhavan at Nariman Point, Mumbai. As the setting sun outside turns the Arabian Sea into a golden shimmering blanket, we decide to delve into the life of the golden boy of the world of trading and investment. His candour and simplicity surprise us, as does the story of his self-sustained career and benevolence.

Tracing his roots

Rakesh Jhunjhunwala’s family hails from the Jhunjhunu district of Rajasthan. While his father, Radheshyam Jhunjhunwala, was born in Mumbai (then Bombay), Rakesh was born in Hyderabad. A government official, Rakesh’s father was posted in many cities. Rakesh came to call Mumbai his home since he was two-and-a-half years old. “I tell everybody that I am Hindu by birth, Marwari Baniya by caste, Mumbaiite by domicile and Indian by spirit,” he says. Rakesh and his family visit his hometown and the family temple in Rajasthan once every two years.

Rakesh schooled at HVB Academy, Mumbai, and earned his BCom from Sydenham College, Mumbai. He later completed his chartered accountancy course in 1984. “I was paid Rs. 90 per month as stipend then, after which I never earned any salary. I have never been employed you see,” he says, recalling those days.

Taking pride in his heritage

When Rakesh first started investing in 1985, he had no money, and his father refused to finance him. Instead, he told Rakesh that he was always welcome to stay in the family house in Walkeshwar, Mumbai. “He told me ‘If you don’t succeed, you can always return and earn Rs 15,000.’ We were a middle-class family, and in 1985, Rs 15,000 was a decent amount. He asked me to be fearless and blessed me,” Rakesh says with a hint of nostalgia. He lost his father in 2008, and now lives with his mother, his wife and three children.

To give him a start, his older brother Rajesh, a practising chartered accountant, helped him borrow money from some of his clients. “That’s how I began,” Rakesh says.

Rakesh has three siblings: Rajesh Jhunjhunwala, Sudha Gupta and Neena Sanganeria. “I am the youngest—the baby of the family. I have only one wife (laughs), one daughter and two sons. We live with my mother,” he says.

Talking about his Marwari background, Rakesh lauds the community by pointing out that if today it has the richest and some of the most successful people, it is because of their hard work and determination. “I belong to the Agarwal community, which has some of the wealthiest people, such as the Piramals, the Guptas, the Ruias, the Mittals, the Modis, and so many more” he says.

“Have you ever wondered why so many successful people hail from such a small area (the Shekhawati region in Rajasthan)?” he asks. “I attribute it to our hard-working and thrifty nature. And this is because we came from an area that is very hostile. Life in Rajasthan is not easy, because there is no rain, no proper irrigation, and that makes us so resilient. I am a proud Marwari, but now we are Mumbaiites, and we are what Mumbai has made us.”

He gives credit to his Marwari genes for his success, although he feels his education and experience have been equal contributors. A first generation businessman, Rakesh wishes people would not use the term Marwari in a derogatory manner. “I feel in India the successful, especially the wealthy, are often looked down upon. Of course, this attitude is changing,” he says.

A loving husband and a doting father

A loving husband and a doting father

Married for 29 years, Rakesh and his wife Rekha are inseparable. A case in point is the name of his company: RARE Enterprises. As if here too they complement each other, the word RARE is the acronym of the first two letters of their respective names (‘Ra’ from Rakesh and ‘Re’ from Rekha). “I have no words to express what she means to me. She is my soulmate and we have the perfect relationship. It is tough to say whose contribution has been greater; we have both contributed equally. She is tolerant and patient, with a lot of compassion,” he smiles. He goes on to show us a video of Rekha that he had recorded on his mother’s 80th birthday celebrations last year. “You know what, we don’t discriminate between our parents. When I got married, my father had told me that now I had two sets of parents, and not one. We are four siblings, but Rekha is my mother’s closest friend,” Rakesh says.

Now that his mother is old, they have employed a full-time nurse for her at home. But it was Rekha who has been taking care of her all these years, even leaving the little ones alone at night to be with her when she was unwell. “But I can tell you, she is lucky as well (laughs)! She is not materialistic at all, and spends all her time with the children,” Rakesh says.

Their daughter was born in 2004, 17 years after their marriage, while their twin sons were born in

2009. All three go to NSS Hill Spring International School, Mumbai.

On the economy

Rakesh is a bullish investor and an optimist to the core. Happy with the overall economic scenario in India, he feels things are only going to get better, especially with demand for goods and services rising and with the present government’s impetus to creating jobs and industries. “Things are looking very positive for India and markets are going to be bullish. And, I am talking about the next 10-15 years,” Rakesh says.

Can India survive another international meltdown? “Although a global slowdown would affect India, it would not amount to hurricane problems in the country. We are one of the most inward looking economies of the world,” he replies. With lakhs of people being born every day, and demand for food, shelter, amenities and luxuries increasing, the effect of a global meltdown in India is bound to wear off in the long run, he feels.

Making an instinctive judgment

Rakesh does not believe in “analysis paralysis”. Instead he invests out of informed ignorance. “We invest in so many companies and sectors—jewellery, watch, pharmaceutical, credit rating agency, hotels—we can’t possibly know everything,” he explains. So, here’s how Rakesh works: Initially, he makes his decision after judging the information available to him. Then, driven by his instincts, he tries to confirm his judgement by analysis and his “experience does help”.

At this point he fishes out a special glossy newsletter that was made to commemorate his 50th birthday, and reads aloud:. ‘A man of freedom who listens to only one voice—his own, with the conviction to prove his contrarian views, a man to whom numbers talk; a man who takes bets on people who make numbers talk. Patience to find, eagerness to execute and conviction to stay—he knows what he knows, and knows nothing beyond, but what he knows is the best that can be known.’ He looks up and says, “So now you know me a little better.”

Rakesh says he is independent in his thinking and has conviction in his thoughts. The ‘Big Bull’ doesn’t like to plan every move he makes. “I can take a few months off, if I so wish, because I have nobody’s money except my own; and I manage nobody’s money except my wife’s. You will find hardly six people in my office. I like to keep things this way,” he says.

Rakesh invests the money he makes from trading people’s money. “Trading is the mother of all my wealth. If I don’t trade people’s money, how do I get the amount I need to invest?” he says.

Measuring one’s worth

When we ask him about his net worth, Rakesh looks amused. “Well, I don’t know. Tell me why should numbers matter? I have more than I need, and less than what people think. I am still a middle-class man with a love for expensive cigarettes and a good drink,” he says. Rakesh admits he wants to earn more wealth than anybody else in the world, but he is not willing to change the means to do that, clarifying, “By ‘means’, I refer to what my conscience allows me to do.”

The joy of giving

The joy of giving

Rakesh has a social conscience that pushes him to give away a big chunk of his earnings in charity every year, which amounts to 25 per cent of his dividend income. This works out to be Rs. 20-25 crore. He supports Agasthya International Foundation, which helps spread education in villages. “I acquired knowledge because I was curious. We want to inspire the same curiosity in children. We believe that if children in rural India can be inspired by science, they will later go on to change the country’s future. So, we are doing various experiments such as carrying science labs on mobile vans and teaching science in villages.”

The foundation is bringing cutting-edge science lessons to rural Indian schools by deploying mobile vans that act as science labs. CNN has even made a film on the initiative called ‘Einstein in the Village’.

It was Rakesh’s father who instilled the value of philanthropy in him. “My father left me stumped when one day he suddenly asked me, ‘What the hell will you do with so much money? Why are you not sharing it with more people?’ I realise that the giver of wealth is God, and I try to share it with the less fortunate,” he says.

Rakesh had tried to run a children’s home but could not. Instead, he is setting up a charitable eye hospital in collaboration with Sankara Eye Care (Coimbatore) in Navi Mumbai. Reluctant to measure his charitable activities in terms of money, he goes on to inform us that he donates every year to the NGO Impact India Foundation, which builds schools for girls in remote villages of Uttar Pradesh and Rajasthan. Apart from heading the

R Jhunjhunwala Foundation, Rakesh also contributes generously to OGQ (Olympic Gold Quest). “The NGO grooms Indian athletes and supports them in every way possible so that they can represent our country in the Olympic Games,” says Rakesh, who has also set up a centre for children combatting cancer in Mumbai.

Rekha and Rakesh have decided that on July 5, 2020, the day he turns 60, he will give Rs. 5,000 crore or 25 per cent of his portfolio value, whichever is less, to charity. “People often ask me why I need to make this public. It’s because I want people to come up to me that day and ask me if I have kept my promise,” Rakesh says.

Drinking life to the lees

At one time, apart from work and charity, it was his love for horses that would keep Rakesh busy. But no longer is that the case. With children at home who wait for him, he prefers to “turn on the music at night and dance with them before they sleep”. “I am slowly withdrawing from races; weekends are strictly for my family now,” he says with a contented smile. Rakesh wants to instil middle-class values in his children. He wants them to appreciate what they have, but to grow up to be fearless and strong-willed. He has the same advice for young investors. “I do believe in luck, and yes it is important. But that doesn’t mean you should not work hard. Carve your own space. Make mistakes, but not so big that you cannot afford them,” he says.

So, would the man with the Midas touch have done anything differently in life if given a chance? “No, I wouldn’t have changed a thing,” Rakesh says. “Maybe I would have changed my personal habits,” he adds as an afterthought.

1 Comment

[…] Read More […]