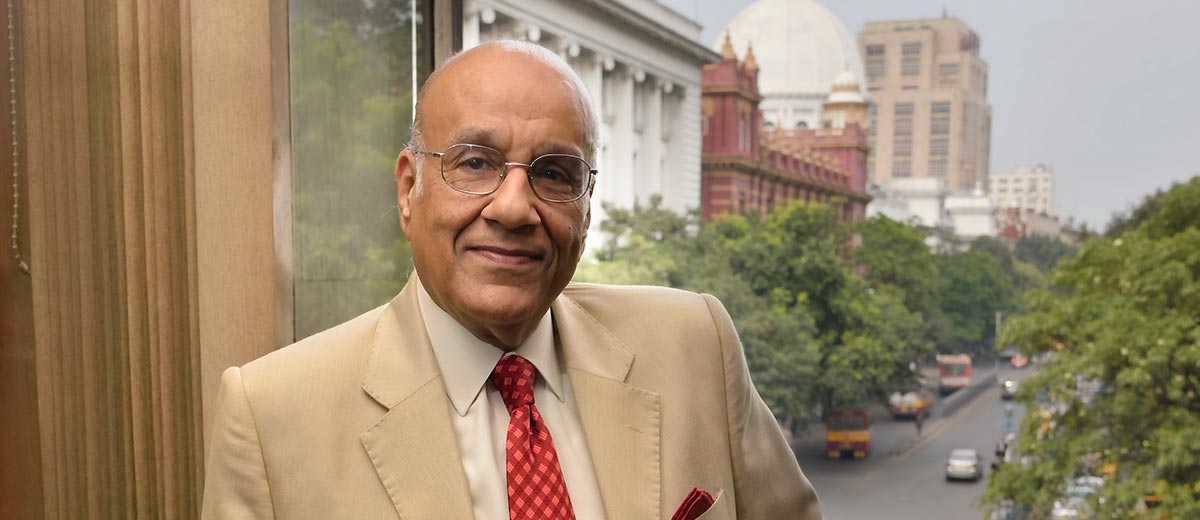

A Cut Above The Rest

Without Saroj Kumar Poddar, the Indian masses might have never used many of the brands that we have taken for granted over the years—Gillette, Singer, Gautier and Duracell, amongst others. His entrepreneurial inputs have affected our lives in many subliminal ways too. The `6,000-crore Zuari Agro Chemicals, the fertiliser wing of the Zuari Group of Companies, is a listed entity which was left to him, along with freight car maker Texmaco, by his father-in-law, the late Dr K K Birla. The flagship company of Poddar’s Adventz Group, Zuari produces widely-used fertilisers, micronutrients, seeds, eco-friendly pesticides and organic manures through the Jai Kisaan brand—a household name amongst the farming community—and impacts our lives more than we know it. After all, it sells up to 2.21 million metric tonnes of fertilisers a year in India.

Bringing Gillette to India

The 68-year-old Marwari industrialist’s journey, over the last 45 years, has been eventful but what were the deals that moulded him and which remain closest to his heart? “I must confess that I certainly recall my early days with Gillette because I started talking to them while I was still in college in Kolkata,” he says, adding, “I would write to them and I would receive a polite letter stating, ‘Mr Poddar, India is a difficult country; we are not interested.’ This carried on for seven years, during which I attended many meetings in London as well as Boston. Finally, the chairman told me, ‘I can fill a room with people from India who have approached us but we have not seen anybody else with so much of commitment, and that is what excites us about working with you.’” Seven years is a long time but armed with perseverance, the adamant young man managed to turn the deal around in trademark Poddar style. “I was very confident that this would take time but if I succeeded, I would make it,” he says simply, effectively driving home the sheer magnitude of the Gillette India deal, the market capitalisation of which stands at `9,320 crore now.

The 68-year-old Marwari industrialist’s journey, over the last 45 years, has been eventful but what were the deals that moulded him and which remain closest to his heart? “I must confess that I certainly recall my early days with Gillette because I started talking to them while I was still in college in Kolkata,” he says, adding, “I would write to them and I would receive a polite letter stating, ‘Mr Poddar, India is a difficult country; we are not interested.’ This carried on for seven years, during which I attended many meetings in London as well as Boston. Finally, the chairman told me, ‘I can fill a room with people from India who have approached us but we have not seen anybody else with so much of commitment, and that is what excites us about working with you.’” Seven years is a long time but armed with perseverance, the adamant young man managed to turn the deal around in trademark Poddar style. “I was very confident that this would take time but if I succeeded, I would make it,” he says simply, effectively driving home the sheer magnitude of the Gillette India deal, the market capitalisation of which stands at `9,320 crore now.

“1970 was the first time Gillette met with me. 1977 was when they gave me the consent to submit the letter of intent to the Government of India. Seven years passed before I obtained an approval. I met everybody—Deputy Secretary, Joint Secretary, Secretary and ministers, including the then PM, Indira Gandhi. Fortunately, it was under Mrs Gandhi’s cabinet that this project was finally approved between 1977 and 1984,” says the founding partner of Gillette India. Not one to mince words about his reluctance to let go of his baby, in order to comply with SEBI regulations—which in recent years made it compulsory for all listed private companies to achieve at least 25 per cent public shareholding—Poddar states that he diluted his shares, keeping the future of the shareholders in mind. “I did want to continue to be the chairman initially but I then realised that this attitude of mine will not gel with the interests of the company,” he finishes.

Back in those days, and especially under the restrictive Foreign Exchange Regulation Act (FERA) passed in 1973, the Indian business climate was not conducive to foreign investment, disabling the private sector from strengthening the Indian economy. “It was very clear that a foreign company would not be allowed to enter the consumer product business unless it sought to sell a product which was of mass consumption, and which only needed upgrading or new technology, and in case there were only one or two manufacturers dominating the market in India,” reminisces Poddar, still the largest independent shareholder, whose five per cent stake (as opposed to his original 27 per cent) in Gillette India is now treated as non-promoter shareholding. He adds: “Razor blades were therefore highly suited as the Harbans Lal Malhotra family controlled 95 per cent of the market and the quality was nowhere comparable to what you could find internationally.” This is the reasoning that Poddar clasped on to while selling the idea to the government, and the rest, as they say, is history.

Dream deals

Another undertaking that is close to his heart is the 50:50 joint venture (JV) with Hettich that was inked in 2000. Poddar, already well established in the furniture business with his company Indian Furniture Products Limited (IFPL), was a logical partner for the Indian arm of the billion-dollar German fittings and hardware company. This was the new millennium and much had changed. Most notable was the fact that the Indian economy had opened up and that a JV was no longer the only way for a foreign firm to operate in India.

Another undertaking that is close to his heart is the 50:50 joint venture (JV) with Hettich that was inked in 2000. Poddar, already well established in the furniture business with his company Indian Furniture Products Limited (IFPL), was a logical partner for the Indian arm of the billion-dollar German fittings and hardware company. This was the new millennium and much had changed. Most notable was the fact that the Indian economy had opened up and that a JV was no longer the only way for a foreign firm to operate in India.

Poddar states that the secret of the success of this business is the “total transparency” between the partners. In fact, the parent company is so happy with the management—which operates wholly out of India—and performance that last year, they joined hands for another 50:50 JV called Hettich Middle East, which will service the whole of the Middle East out of India. Additionally, Hettich India launched a r100-crore manufacturing plant in Vadodara last year and announced an investment plan of r500 crore, over the next five years, to capitalise on the Indian talent pool, apt legal environment and burgeoning domestic market demand. “A second manufacturing project is under installation and we will be launching a third one next year. So I certainly see the company growing significantly over the next few years,” Poddar confides, offering us a peek into the company’s aggressive expansion plans. Then he adds, “Another leader that I brought to India is Duracell,” before quipping: “In fact, because of my partnership with Duracell (in 1994), Gillette, one day, decided that Duracell was a good company for them to acquire. The first meeting between them was arranged by me so I had a very minor but initial role in Gillette’s acquisition of Duracell.”

Education, exposure, technology

A gold medalist in BCom from Calcutta University, Poddar asserts that a global understanding of business, foreign education and international exposure are absolute musts for business families today. This rings especially true in the fertiliser business, which contributes the lion’s share of the group’s overall revenue—almost a whopping r12,000 crore—as all areas with backward integration have to be configured abroad. “Education abroad is especially relevant in the fertiliser field where everything has to be imported, including ammonia. We are committed to growing internationally as a group, and we will,” he states matter-of-factly.

A gold medalist in BCom from Calcutta University, Poddar asserts that a global understanding of business, foreign education and international exposure are absolute musts for business families today. This rings especially true in the fertiliser business, which contributes the lion’s share of the group’s overall revenue—almost a whopping r12,000 crore—as all areas with backward integration have to be configured abroad. “Education abroad is especially relevant in the fertiliser field where everything has to be imported, including ammonia. We are committed to growing internationally as a group, and we will,” he states matter-of-factly.

Presently, the Adventz Group fertiliser business is strategically spread out all across eastern, western and southern India, with Chambal Fertilisers (another erstwhile K K Birla firm which has been jointly inherited by the Bhartia, Nopany and Poddar families) servicing the northern parts of the country. Efforts to de-risk the business are going on in full swing. A `4,500-crore integrated diammonium phosphate (DAP) manufacturing facility was launched in collaboration with Ras al-Khaimah (RAK) Maritime City in the UAE earlier this year. To ensure the project’s viability, the group has acquired an interest in a rock phosphate mine in Peru, in partnership with Mitsubishi Corporation of Japan and Peru’s Fosfatos del Pacifico (Fospac). Further, Zuari Agro Chemicals Ltd has entered into a 50:50 JV with Casablanca-based Maroc Phosphore SA, a wholly owned subsidiary of leading global phosphate producer OCP, to create Odisha-based Paradeep Phosphates. A water-soluble speciality fertiliser plant with an annual production capacity of 36,000 tonnes, and costing to the tune of `22 crore, is being operated by Maharashtra-based Zuari Rotem Speciality Fertilisers Ltd as a joint venture between Zuari and Rotem Amfert Negev (of Israel Chemicals Ltd) since the last three years.

As for the heavy engineering side of things, Texmaco Rail has recently acquired Kalindee Rail Nirman which it had had its eye on for a while, apart from installing a `100-crore coach factory in Kolkata, where Poddar wants to manufacture metro coaches, with the help of Japanese bigwig Kawasaki. “To ensure the productivity of the unit, we had to secure a product line that complements Indian Railways. Japan and India share a very special relationship. While Japan has an abundance of credit granted by its government for the construction of dedicated freight corridors, apart from the finest technologies, India has a promising future in terms of infrastructure opportunities,” he explains. Moreover, he has also been actively initiating a wealth of new technology—including the use of robotic welders, which is practically unheard of in India, to make wagons—into the group to ensure that it is a step ahead of competition.

As for the heavy engineering side of things, Texmaco Rail has recently acquired Kalindee Rail Nirman which it had had its eye on for a while, apart from installing a `100-crore coach factory in Kolkata, where Poddar wants to manufacture metro coaches, with the help of Japanese bigwig Kawasaki. “To ensure the productivity of the unit, we had to secure a product line that complements Indian Railways. Japan and India share a very special relationship. While Japan has an abundance of credit granted by its government for the construction of dedicated freight corridors, apart from the finest technologies, India has a promising future in terms of infrastructure opportunities,” he explains. Moreover, he has also been actively initiating a wealth of new technology—including the use of robotic welders, which is practically unheard of in India, to make wagons—into the group to ensure that it is a step ahead of competition.

Values

“As you know, Marwari training, discipline and commitment is what you naturally inherit from the family. In a Marwari family, you learn it all the time, because all discussions are centred around business,” says Poddar who comes from Kolkata’s old moneyed Poddar family, whose business interests spanned textiles, jute, tea and coal. “I was extremely fortunate that my father, and then my father-in-law, really believed in inculcating a value system. So, we have always been fair to our suppliers, partners, employees and customers. And as a result, I have had the privilege of being the chairman of some multinational corporations—like Avery and Areva—without holding any equity!” adds he.

“As you know, Marwari training, discipline and commitment is what you naturally inherit from the family. In a Marwari family, you learn it all the time, because all discussions are centred around business,” says Poddar who comes from Kolkata’s old moneyed Poddar family, whose business interests spanned textiles, jute, tea and coal. “I was extremely fortunate that my father, and then my father-in-law, really believed in inculcating a value system. So, we have always been fair to our suppliers, partners, employees and customers. And as a result, I have had the privilege of being the chairman of some multinational corporations—like Avery and Areva—without holding any equity!” adds he.

The top qualities treasured by the mild-tempered Poddar are honesty and humility. “If you have a sense of integrity, honesty and transparency, and if you can combine these with humility, it is a great asset. If you are brilliant but arrogant, how many people would like to do business with you?” rhetorically asks Poddar, who has grown his businesses far and wide from Gujarat and Goa to Bengal, and from Himachal Pradesh all the way down to Tamil Nadu.

It is also because of his grounded personality that he has been able to chair Chambal Fertilisers, which could have been a tricky affair, without causing any friction between the co-owners. When asked about how differences are sorted out in the boardroom, Poddar smoothly replies that all decisions are taken in the best interests of the company. “You should look at Chambal as a joint-venture company. In JVs, you can’t look at short-term gains. It’s important to create value for the shareholders and grow the company, and that is exactly what happened at Gillette, and that is what is happening at Chambal,” says the likeable businessman.

I enquire about his close relationship with Vijay Mallya and his stake in Mallya’s Mangalore Chemicals and Fertilisers (MCF), which helped stave off a hostile takeover from Deepak Fertilizers. “When I spoke to him, he was very clear that he would like to continue running the business, but didn’t mind if Zuari cut in. It was a win-win situation for both of us,” he says. But you get the feeling that he had also wanted to help out an old friend.

A straight-thinking titan

At first sight, Poddar comes across as gracious, well-mannered and attentive. That he dictated 10 points to answer a question that I had asked him on an earlier call—what qualities would he like to pass on to future generations? —also points to his meticulousness and sincerity. Under the soft-spoken demeanour, I had started to identify other traits too: a remarkable memory, a wonderful sagacity and above all, a winsome nature.

It seems me that what truly drives Poddar is undertaking a challenge, be it reviving the sick Texmaco in 2002-3, and then diversifying it through new ventures, mergers and acquisitions, or forging powerful foreign alliances. But when I voice my opinion, he sidesteps the praise gracefully and simplifies the situation: “When the GDP grows at eight or nine per cent, most are likely to do well. In the case of Texmaco, all I ensured was updating of the brand and equipment. We discontinued unprofitable lines, reduced cost and revamped the company.” He does reveal, however, that resurrecting Texmaco and co-promoting Gillette India (now owned by Netherlands-based FMCG major P&G, which acquired its parent company nearly a decade ago) are the biggest milestones of his business career, followed by the expansion of Zuari, the Hettich JV and the Ras al-Khaimah project.

Family values are so deeply ingrained in Poddar that every Sunday, dinner is had with the whole family (including his daughter Shradha and her family), something that he clearly looks forward to. “My family is my greatest asset. My brothers feel I should take life easy, but my wife and son, who are very supportive, think I should go on,” says he.

He relaxes by playing cards or watching cricket, an interest shared by wife Jyotsna, who has penned the book, Cricketing Memories, for which legendary cricketer, Sir Donald Bradman, happens to have written the foreword. And here’s another thing we can all be grateful to the Poddars for: Remarkably, Sachin Tendulkar (who happens to be Poddar’s favourite cricketer) was sent abroad for training for the very first time by Mrs Poddar’s trust—Young Cricketer’s Organisation—way back in 1988!